When the first wave of the Covid pandemic hit the planet in 2020 and billions of people were forced into an unprecedented lockdown, nature sent out a clear and beautiful message—pristine blue skies over the dirtiest cities, polluted rivers running clear and wildlife returning to places desecrated by humans. For humanity, the moral of the story is clear. Act now. Clean up. For a country like India, where vehicular pollution accounts for about 11 per cent of the country’s carbon emissions, the answer, perhaps, lies elsewhere. In the future-ready Electric Vehicles (EVs), widely acknowledged as the answer to the world’s depleting fossil fuel reserves and growing pollution.

India Pushes For Electric Vehicles To Cut Down Pollution, Fuel Import Bills

India is pushing for eco-friendly vehicles to cut fuel import bills and clean up its polluted air

Not surprisingly, India is looking at the future-ready EVs to cut down on inflated fuel import bills and save the environment.? A draft proposal by NITI Aayog in 2020 said if electric vehicles were adopted widely, India could slash as mush as $40 billion off its oil import bill by 2030. In fact, the Indian government has already laid out a target of ensuring that at least 30 per cent of vehicles in the country are electric by 2030.

Over the past couple of years, attractive incentives by the central and state governments, both to buyers and car-makers, have given a boost to EV sales in India, especially in the two-wheeler category. In the financial year 2019-20, EV sales in India clocked 3.8 lakh units, while the EV battery market stood at 5.4GWh (gigawatt hours)during the same year, according to the India Energy Storage Alliance (IESA). The two-wheeler (e-2W) market has been accounting for the highest share of EV sales. In 2010-21, for instance, two-wheelers accounted for over 50 per cent of overall sales of around 2.38 lakh units. However, the number of two-wheeler sales had dipped due to the Covid pandemic, falling to around 1.44 lakh units from the previous high of? 1.52 lakh units, data from the Society of Manufacturers of Electric Vehicles (SMEV) showed.

Though still a nascent sector in India, sale of electric cars rose last year to 5,905 from a low base of 2,814 in the previous year—and Tata’s Nexon EV acc-ounted for 64 per cent of the sales. Three wheeler sales jumped from 88,378 to 1.41 lakh units in 2020-21 as many states, including Delhi, pushed for a switch from petrol vehicles to green energy to tackle rising air pollution. “Good policy interventions have been the growth driver of EVs in the last few years. The policy change last month has been in favour of large scale adoption of e-vehicles. So as an industry we are optimistic that despite the impact of Covid, this year we will witness growth in sales, not only in terms of percentage but also numbers,” says Sohinder Gill, director general of SMEV. For 2021-22, Gill has projected that two-wheeler sales will cross 2.10 lakh to 2.20 lakh units. The ind-ustry also expects EV car sales to inc-rease but possibly not more than 10,000 units. In the e-rickshaw and three-wheeler category, the industry’s sale est-imates are around 2 lakh to 2.5 lakh units as many states are pushing for green commercial vehicles. However, e-rickshaws are largely made by the uno-rganised sector and hence there is no proper record of their numbers.

But the numbers still remain very low compared to some other countries. “The total EV market in India is not even 0.5 per cent of the total vehicles sold in the country,” says Saharsh Damani, CEO of the Federation of Automobile Dealers’ Associations. However, Niti Aayog has said that India’s electric vehicle financing industry is likely to be worth Rs 3.7 lakh crore by the end of the decade.

The first big push for EVs came in 2013 when the central government unveiled the National Electric Mobility Mission Plan 2020. Under the mission plan, the FAME India Scheme—for faster adoption and manufacturing of hybrid and electric vehicles—was launched in 2015. In 2019, the central government raised the subsidies on hybrid and electric vehicles under the FAME II policy. However, this was only app-licable for commercial use and the subsidies provided was up to Rs 1.50 lakh for each car and Rs 30,000 for each two-wheeler. For personal use, electric cars have the lowest GST rate at 5 per cent. Recently, the central government dec-ided to increase FAME II incentives for electric two-wheelers to Rs 15,000 per kWh. Out of the Rs 10,000 crore subsidy earmarked in the FAME II scheme, two-wheelers are the largest beneficiary, specially the e-scooters.

The results are encouraging. States which have announced incentives for buyers are seeing a rise in sales, like Gujarat, Karnataka, Tamil Nadu and Maharashtra, among others. In Delhi, the incentive for commercial vehicles is such that the demand is more than supply, says Damani. In the two-wheeler segment, in particular, the demand is growing very rapidly due to low GST and other incentives being offered by the government.

Although 14 states have so far ann-o-u-nced EV policies—10 for setting up cha-rging infrastructure and four for local manufacturing—and eight states are offering customer incentives, exp-erts say that many of them are yet to be imp-lemented. The promise of EV-friendly policies has encouraged a large number of start-ups to set up manufacturing fac-ilities across the country. Even foreign players like GM Motors India has set up an EV manufacturing unit, while others like Tesla India are being wooed by the Gujarat government.

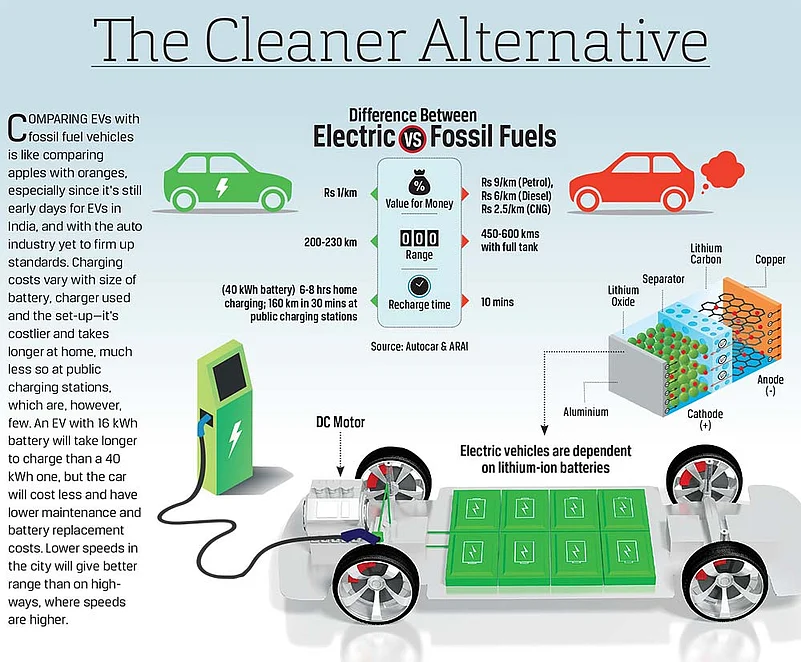

Tejinderpal Miglani, a Gurgaon-based entrepreneur, swapped his petrol SUV for an MG electric vehicle in February last year. Miglani says his new car gives him 370-380 km per full charge as against the stated mileage of 320 km, while his running cost has come down from Rs 6/km to just around Rs 1/km depending on traffic conditions. With the air-conditioning on, the mileage drops to 280-300 km, he adds. Miglani charges his car at home using the AC socket; it takes him less than 6 hours to fully recharge it. As the car cost was over Rs 15 lakhs, it did not benefit from government subsidy except the lower GST.

However, there is still customer hesitancy in going for EVs as they take too long to recharge, are not available with the same features and styles as petrol or diesel vehicles and are far more expensive than the conventional fuel vehicles.

Tarun Mehta, CEO and co-founder of Ather Energy, says the challenge in the EV sector is to keep ahead of the curve, with customers seeking more features and improvements in applications. To tackle the challenge of fast charging, many of the new companies like Ather are investing in setting up charging points in cities across the country while others, like Jaipur-based HOP Electric Mobility, are making arrangements to enable its customers to swap discharged battery with a fully charged battery without having to wait. HOP is planning to raise its production of two-wheelers given the rising demand for its two products even as it plans more new product launches, including an e-bike this year. Atulya Mittal, Founder of Nexzu Mobility, also reveals that initially the company plans to focus on the two-wheeler segment “as it is more relevant for India”. The company, with a manufacturing plant at Chakan near Pune, is getting good response from its network of 70-plus dealers for its products—e-scooters and e-cycles.

Prevail Electric also recently launched three light-weight aluminium scooter models with premium features. “We foresee hyper growth in the Indian EV market and are continuously working to add more products that are convenient and comfortable for all customers, irrespective of their age or gender,” says Hemant Bhatt, CEO of Prevail Electric.

Last year saw the entry of large auto players like Bajaj and TVS into the EV two-wheeler segment. Others like Hero Electric and Ola have also firmed up plans of entering the market with offerings in 2022. Bigger players are planning to enter the four-wheel segment, while some like Kinetic plans expanding beyond three-wheelers. MG Motor India plans to introduce a sub-20 lakh EV by mid-next year to exp-and the reach of EVs to a wider customer segment. Gaurav Gupta, the company’s chief commercial officer, says it is setting up an EV battery plant, in addition to expanding charging infrastructure across the country.? The company has also tied up with IIT Delhi for further research and development on? EV technology.

As the central government tightens norms for localisation and quality with tighter certification rules, many small players are expected to face a major challenge to survive. With the industry also shifting gears in search of better tech specifications and features, those lagging behind are likely to lose out.

The challenge for foreign players is that they would have to source most of the components locally. Also, products of auto giants like Tesla do not qualify for subsidy at it applies only for vehicles costing less than Rs 15 lakh. And, though the government is pushing to improve infrastructure to support operation of EVs, there is still a wide gap between requirement and on-ground support. The government has committed to having charging points on highways and within the cities. But the process will take time as the number of EVs on the road are not adequate to make investments.

India currently has around 69,000 petrol pumps where charging facility for electric vehicles is available. India is planning to use solar energy to charge batteries of electric vehicles. In the absence of adequate charging points, many people are currently charging their vehicles at home using normal sockets while some have been provided special chargers by their veh-icle manufacturers.

(This appeared in the print edition as "Right turn to e-Highway")